Interrupted Time Series#

Interrupted time series (ITS) analysis is econometrics approach that allows us to evaluate the impact of an intervention or policy change that occurs at a specific point in time [BCG17]. Unlike DiD, ITS does not require a control group as it assumes that the data-generating process would have continued in a similar way without the introduction of the new policy. ITS can be seen as a special case of a regression discontinuity design (RDD). In a typical RDD, the discontinuity is observed across different units based on a cutoff point. For example, the introduction of a special tax for plants over a certain size. ITS work in a similar way but instead of having the discontinuity based on a specific variable, the discontinuity occurs over time. Then, we can model the time series of interest using a segmented regression approach as in:

where the regression coefficients are used to capture:

The baseline intercept (\(\beta_0\)).

The pre-policy slope (\(\beta_1\)).

The change in level at the introduction of the new policy (\(\beta_2\)). It should be noted that “period” is a dummy variable (0 or 1) that indicates whether the observation is from the period before the policy implementation (0) or after (1).

The change in slope after the introduction of the new policy (\(\beta_3\)).

Example#

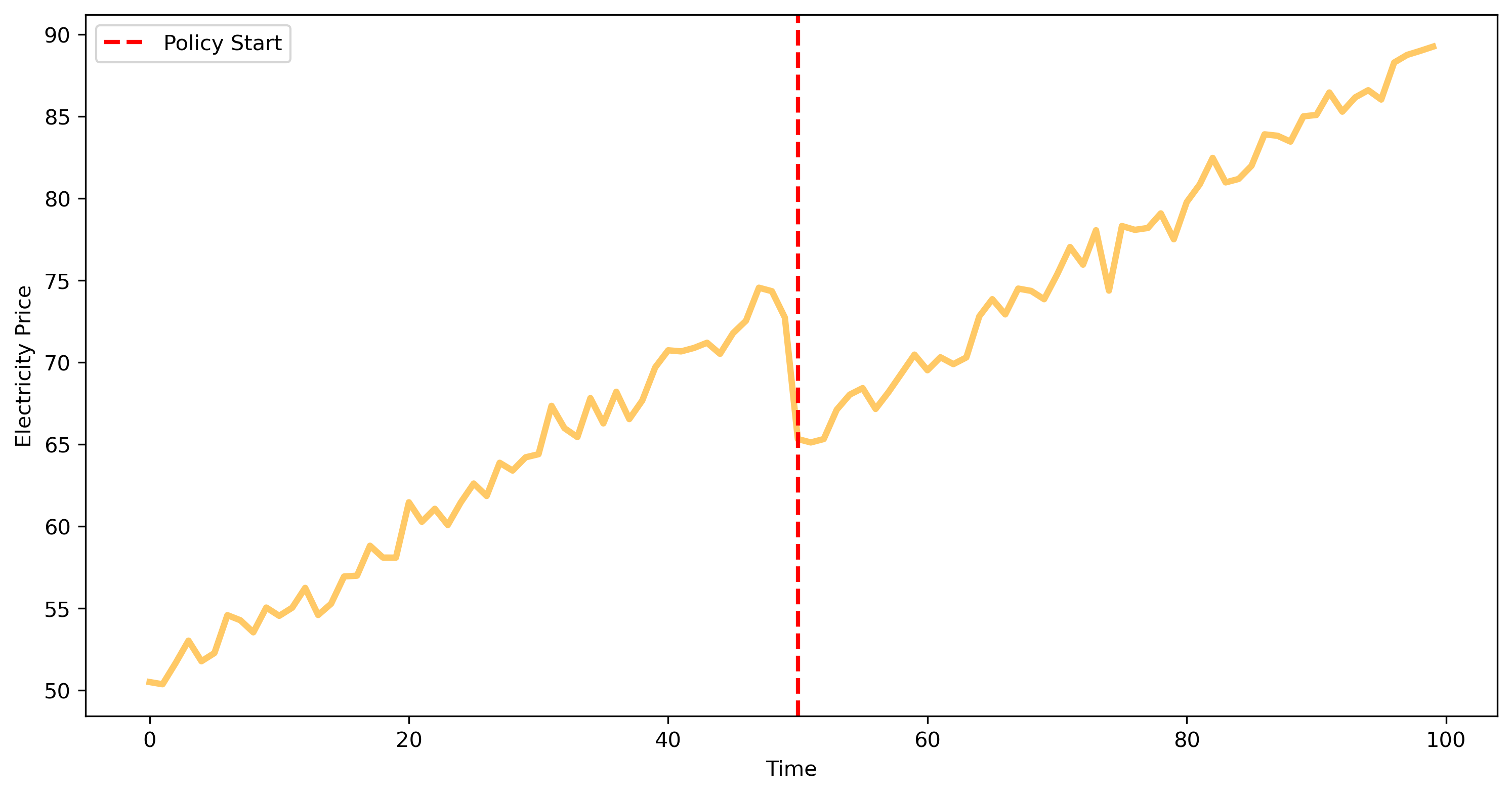

Let’s now try to generate some data to try and apply this methodology in a practical example.

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

# Set random seed for reproducibility

np.random.seed(42)

# Generate time series data

n_periods = 100

time = np.arange(n_periods)

policy_start = 50 # Time when the policy starts

# Generate prices with a trend and some noise

prices = 50 + 0.5 * time + np.random.normal(scale=1, size=n_periods)

# Introduce a policy effect (e.g., a reduction in prices)

prices[policy_start:] += -10

# Create a DataFrame

data = pd.DataFrame({

'time': time,

'price': prices

})

# Plot the data

plt.figure(figsize=(12, 6), dpi=300)

plt.plot(data['time'], data['price'], lw=3, alpha=.6, c='orange')

plt.axvline(policy_start, color='red', linestyle='--', label='Policy Start', lw=2)

plt.xlabel('Time')

plt.ylabel('Electricity Price')

plt.legend()

plt.show()

Intel MKL WARNING: Support of Intel(R) Streaming SIMD Extensions 4.2 (Intel(R) SSE4.2) enabled only processors has been deprecated. Intel oneAPI Math Kernel Library 2025.0 will require Intel(R) Advanced Vector Extensions (Intel(R) AVX) instructions.

Intel MKL WARNING: Support of Intel(R) Streaming SIMD Extensions 4.2 (Intel(R) SSE4.2) enabled only processors has been deprecated. Intel oneAPI Math Kernel Library 2025.0 will require Intel(R) Advanced Vector Extensions (Intel(R) AVX) instructions.

Here, we introduced a policy at time step 50, which causes a price reduction of 10 units. Let’s now create the dummy variables and fit a segmented regression model to show if we are able to estimate the effect of the policy.

# Create the time after policy variable

data['time_after_policy'] = np.where(data['time'] >= policy_start, data['time'] - policy_start, 0)

data['period'] = np.where(data['time'] >= policy_start, 1, 0)

import statsmodels.api as sm

# Define the independent variables

X = sm.add_constant(data[['time', 'period', 'time_after_policy']])

y = data['price']

# Fit the OLS model

model = sm.OLS(y, X).fit()

print(model.summary())

Intel MKL WARNING: Support of Intel(R) Streaming SIMD Extensions 4.2 (Intel(R) SSE4.2) enabled only processors has been deprecated. Intel oneAPI Math Kernel Library 2025.0 will require Intel(R) Advanced Vector Extensions (Intel(R) AVX) instructions.

OLS Regression Results

==============================================================================

Dep. Variable: price R-squared: 0.993

Model: OLS Adj. R-squared: 0.993

Method: Least Squares F-statistic: 4425.

Date: Mon, 23 Dec 2024 Prob (F-statistic): 9.73e-103

Time: 09:55:43 Log-Likelihood: -129.67

No. Observations: 100 AIC: 267.3

Df Residuals: 96 BIC: 277.8

Df Model: 3

Covariance Type: nonrobust

=====================================================================================

coef std err t P>|t| [0.025 0.975]

-------------------------------------------------------------------------------------

const 50.0644 0.252 198.924 0.000 49.565 50.564

time 0.4882 0.009 55.153 0.000 0.471 0.506

period -9.3026 0.361 -25.742 0.000 -10.020 -8.585

time_after_policy 0.0056 0.013 0.448 0.655 -0.019 0.030

==============================================================================

Omnibus: 0.634 Durbin-Watson: 2.094

Prob(Omnibus): 0.728 Jarque-Bera (JB): 0.440

Skew: -0.162 Prob(JB): 0.802

Kurtosis: 3.027 Cond. No. 252.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

As we can see, the results show:

The baseline price before the policy was 50 (\(\beta_0\) = const).

The prices were increasing by approximately 0.5 units per time period before the policy (\(\beta_1\) = time).

There was an immediate reduction of 9.3 units (fairly close to 10) in the price level after the policy (\(\beta_2\) = period).

The trend (slope) of prices did not significantly change after the policy (\(\beta_3\) = time_after_policy).

Preprocessing the Data#

Many real-world data might be characterised by high autocorrelation or more complex dynamics. In that case, it might be useful to firts fit a model and then examine the behaviour of the residuals to estimate the effect of the policy. For example, using a time series model (e.g., SARIMA) followed by ITS analysis on the residuals might have several advantages, such as:

Handling autocorrelation and seasonality: time series data often exhibit autocorrelation and seasonality, where current values are correlated with past values. Ignoring this aspect can lead to incorrect inferences and underestimated standard errors. By fitting a SARIMA model, we explicitly account for this, leading to more accurate residuals that reflect the underlying stochastic process.

Isolating the intervention effect: by first modeling the time-dependent structure of the data (i.e., the autocorrelation), we can better isolate the effect of the intervention. The residuals from the SARIMA model represent the portion of the time series that is not explained by its own past values, thus providing a clearer signal of any intervention effects.

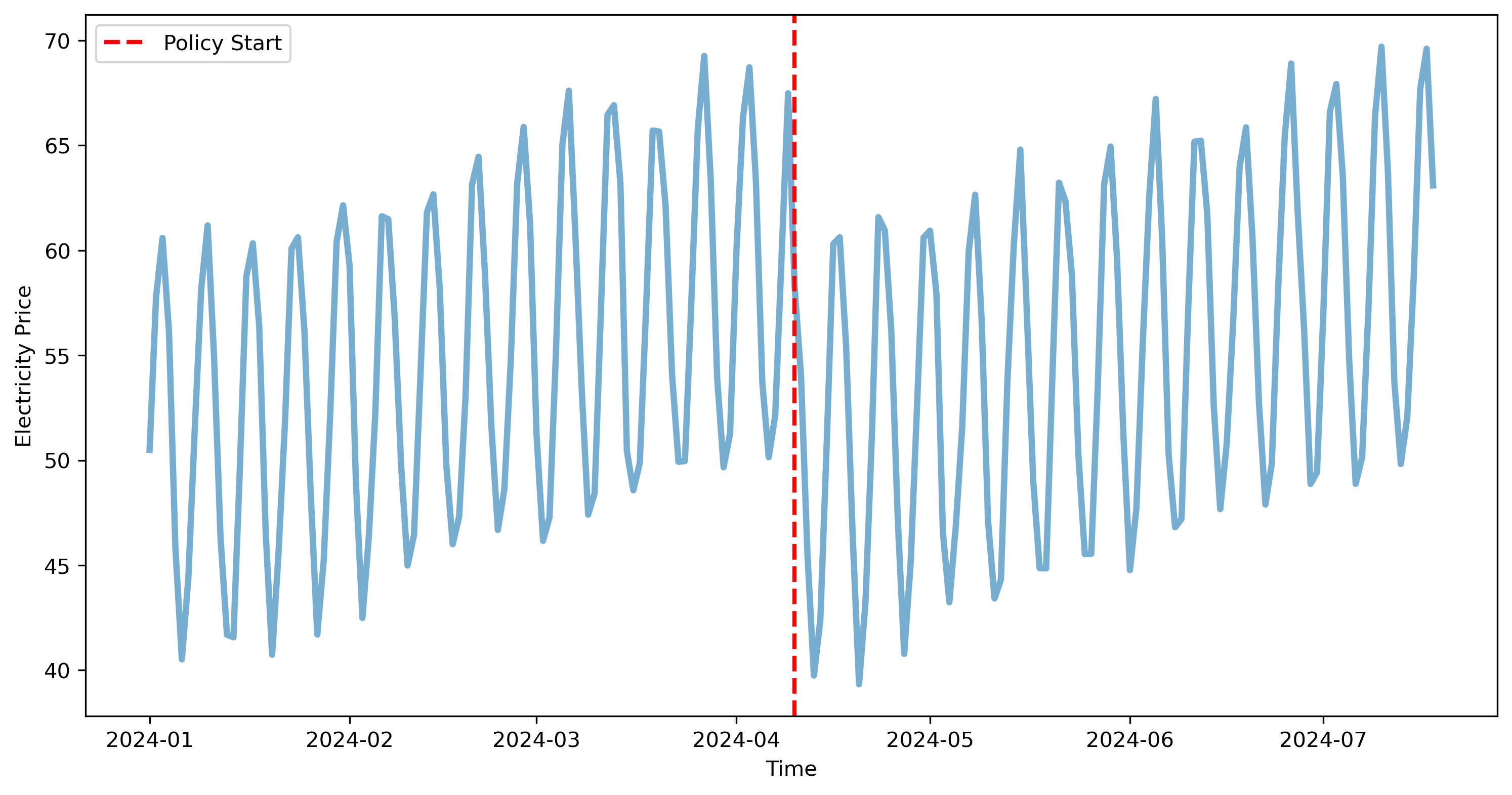

Let’s try and generate some data, where we fit a SARIMA model on the pre-policy data, and use it to whiten the whole time series observed. Also in this case, we assume the policy effect is to reduce prices by 10 units.

# Set random seed for reproducibility

np.random.seed(42)

# Generate time series data with seasonality, trend, and some noise

n_periods = 200

time = pd.date_range(start='2024-01-01', periods=n_periods, freq='D')

seasonal_period = 7

policy_start = 100 # Time index when the policy starts

# Generate seasonal component

seasonal_effect = 10 * np.sin(2 * np.pi / seasonal_period * np.arange(n_periods))

# Generate trend component

trend_effect = 0.1 * np.arange(n_periods)

# Generate noise component

noise = np.random.normal(scale=1, size=n_periods)

# Combine components

prices = 50 + seasonal_effect + trend_effect + noise

# Introduce a policy effect (e.g., a reduction in prices)

prices[policy_start:] -= 10

# Create a DataFrame

its_data = pd.DataFrame({

'time': time,

'price': prices

})

# Set the index to the datetime

its_data.set_index('time', inplace=True)

its_data.index = pd.DatetimeIndex(its_data.index, freq='D')

# Plot the data

plt.figure(figsize=(12, 6), dpi=300)

plt.plot(its_data.index, its_data['price'], lw=3, alpha=.6)

plt.axvline(its_data.index[policy_start], color='red', linestyle='--', label='Policy Start', lw=2)

plt.xlabel('Time')

plt.ylabel('Electricity Price')

plt.legend()

plt.show()

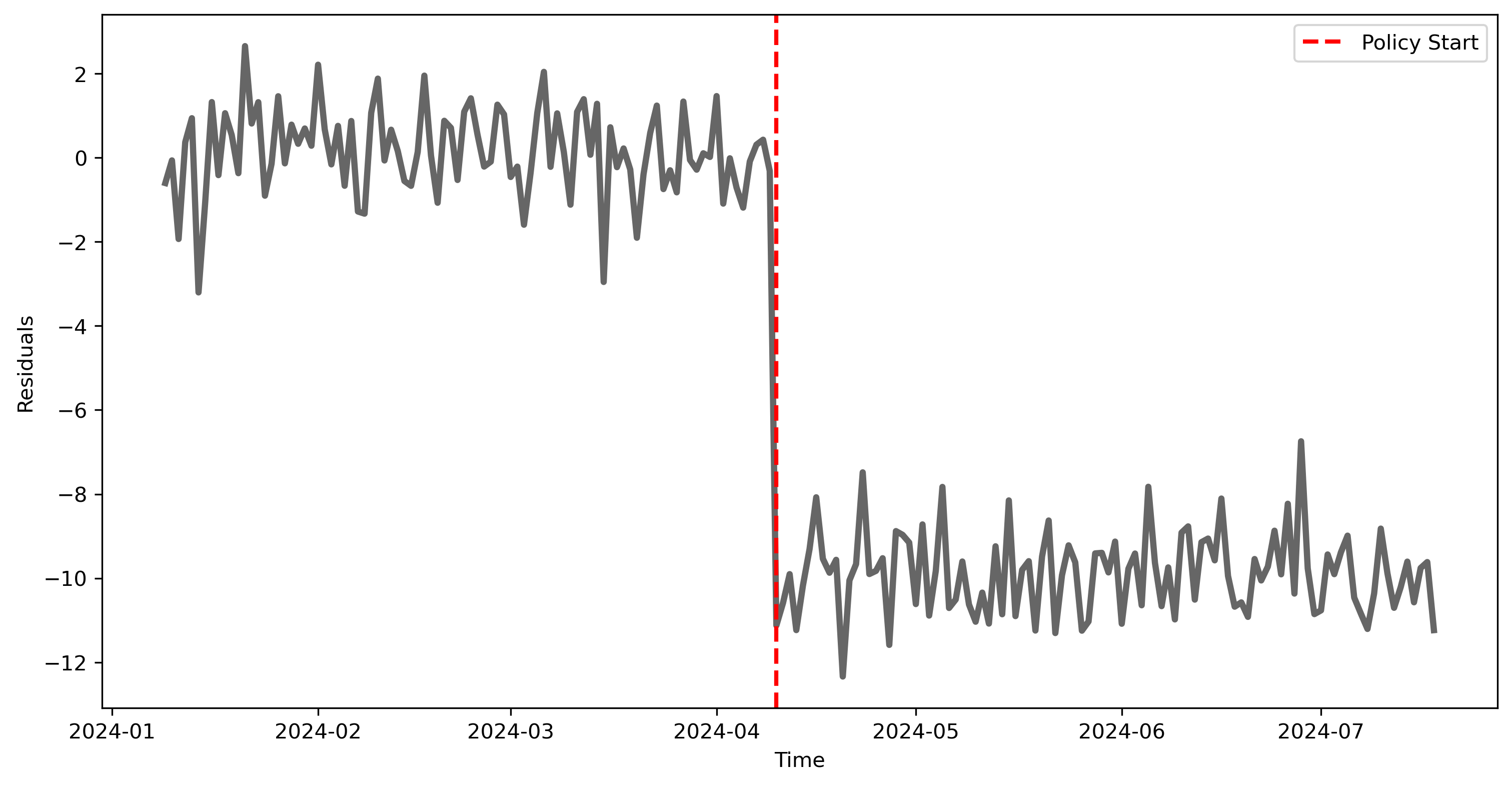

Since the policy has been introduced at the 100th observation, we can fint a SARIMA model on the first 100 observations, and then perform and ITS analysis on the reisudals.

from statsmodels.tsa.statespace.sarimax import SARIMAX

# Fit a SARIMA model to the pre-intervention period

pre_policy_data = its_data.iloc[:policy_start]

sarima_model = SARIMAX(pre_policy_data['price'], order=(1, 1, 1), seasonal_order=(1, 1, 1, seasonal_period)).fit(disp=False)

# Get the residuals for the entire time series

its_data['residuals'] = its_data['price'] - sarima_model.predict(start=0, end=n_periods-1, dynamic=False)

# Plot the data

plt.figure(figsize=(12, 6), dpi=300)

plt.plot(its_data.index[8:], its_data['residuals'][8:], lw=3, alpha=.6, c='k')

plt.axvline(its_data.index[policy_start], color='red', linestyle='--', label='Policy Start', lw=2)

plt.xlabel('Time')

plt.ylabel('Residuals')

plt.legend()

plt.show()

Intel MKL WARNING: Support of Intel(R) Streaming SIMD Extensions 4.2 (Intel(R) SSE4.2) enabled only processors has been deprecated. Intel oneAPI Math Kernel Library 2025.0 will require Intel(R) Advanced Vector Extensions (Intel(R) AVX) instructions.

As expected, given the change due to the new policy, the residuals before the policy (where we fitted the model) are quite low, while they are much higher after the policy was introduced.

We can now add the necessary dummy variables to perform the ITS analysis.

# Create the time after policy variable

its_data['time_after_policy'] = np.where(its_data.index >= its_data.index[policy_start], np.arange(len(its_data)) - policy_start, 0)

its_data['policy'] = np.where(its_data.index >= its_data.index[policy_start], 1, 0)

its_data

| price | residuals | time_after_policy | policy | |

|---|---|---|---|---|

| time | ||||

| 2024-01-01 | 50.496714 | 50.496714 | 0 | 0 |

| 2024-01-02 | 57.780051 | 7.283374 | 0 | 0 |

| 2024-01-03 | 60.596968 | 2.816929 | 0 | 0 |

| 2024-01-04 | 56.161867 | -4.435096 | 0 | 0 |

| 2024-01-05 | 45.827009 | -10.334864 | 0 | 0 |

| ... | ... | ... | ... | ... |

| 2024-07-14 | 52.067003 | -9.606215 | 95 | 1 |

| 2024-07-15 | 58.716143 | -10.573337 | 96 | 1 |

| 2024-07-16 | 67.672040 | -9.758902 | 97 | 1 |

| 2024-07-17 | 69.607488 | -9.616603 | 98 | 1 |

| 2024-07-18 | 63.095867 | -11.235880 | 99 | 1 |

200 rows × 4 columns

Now, let’s fit an segmented regression model, using OLS, as we did in the first part of the chapter.

# Define the independent variables for the ITS model

X = sm.add_constant(its_data[['time_after_policy', 'policy']])

y = its_data['residuals']

# Fit the OLS model on the residuals

its_model_on_residuals = sm.OLS(y, X).fit()

print(its_model_on_residuals.summary())

Intel MKL WARNING: Support of Intel(R) Streaming SIMD Extensions 4.2 (Intel(R) SSE4.2) enabled only processors has been deprecated. Intel oneAPI Math Kernel Library 2025.0 will require Intel(R) Advanced Vector Extensions (Intel(R) AVX) instructions.

OLS Regression Results

==============================================================================

Dep. Variable: residuals R-squared: 0.616

Model: OLS Adj. R-squared: 0.613

Method: Least Squares F-statistic: 158.3

Date: Mon, 23 Dec 2024 Prob (F-statistic): 1.02e-41

Time: 09:55:44 Log-Likelihood: -563.84

No. Observations: 200 AIC: 1134.

Df Residuals: 197 BIC: 1144.

Df Model: 2

Covariance Type: nonrobust

=====================================================================================

coef std err t P>|t| [0.025 0.975]

-------------------------------------------------------------------------------------

const 0.3999 0.409 0.979 0.329 -0.406 1.206

time_after_policy 0.0006 0.014 0.041 0.967 -0.027 0.029

policy -10.3131 0.908 -11.352 0.000 -12.105 -8.522

==============================================================================

Omnibus: 353.785 Durbin-Watson: 0.997

Prob(Omnibus): 0.000 Jarque-Bera (JB): 114456.753

Skew: 8.849 Prob(JB): 0.00

Kurtosis: 118.852 Cond. No. 130.

==============================================================================

Notes:

[1] Standard Errors assume that the covariance matrix of the errors is correctly specified.

We can see how we were able to estimate the effect of the policy quite well.

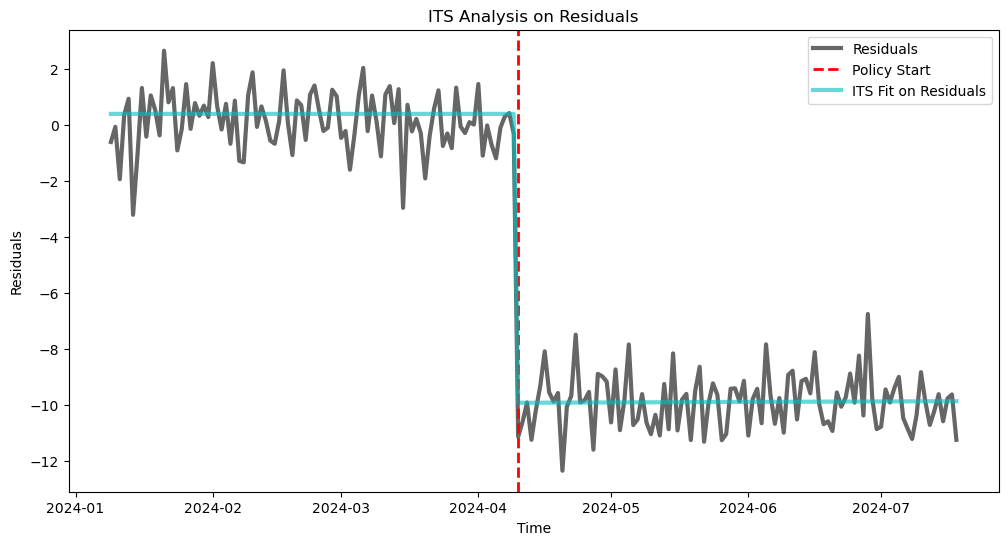

# Plot the residuals and the ITS fit

plt.figure(figsize=(12, 6))

plt.plot(its_data.index[8:], its_data['residuals'][8:], label='Residuals', lw=3, alpha=.6, c='k')

plt.axvline(its_data.index[policy_start], color='red', linestyle='--', label='Policy Start', lw=2)

plt.plot(its_data.index[8:], its_model_on_residuals.predict(X)[8:], color='c', label='ITS Fit on Residuals', lw=3, alpha=.6)

plt.xlabel('Time')

plt.ylabel('Residuals')

plt.title('ITS Analysis on Residuals')

plt.legend()

plt.show()